The Benefits of Diversification

Diversification & Hedging

Diversification and hedging are often interchanged, however, they have very different characteristics:

Diversification is adding a return stream that is unrelated to your core portfolio. This means that as your core portfolio goes up or down, there is no direct relationship and the diversifying return stream can go up, down or sideways. Mathematically, a perfect diversification has a correlation of 0%. A hedge is a return stream that we expect to act in the opposite direction of your core portfolio. For this to occur, there must be a direct relationship. We expect when the core portfolio goes down, the hedge goes up, and vice versa. Mathematically, a perfect hedge has a correlation of -100%.

We do not want to diversify just for diversifications sake; we only want to diversify with a return stream that we believe, in its own right, has a positive expected return. Given this characteristic, adding a return stream that moves in the opposite direction [hedge] is not a return stream that has a positive expected return which is why we do not like hedging. So why do people hedge? A hedge can be viewed similar to an insurance premium which some people are happy to pay despite the negative return outlook – think of paying your house insurance and car insurance premiums. It will pay us well when we need it, however we tend not to need if very often, so over our lifetime, we pay more in premiums than what it pays us.

Timing Uncertainty

No-one knows what is going to happen in the market. More importantly, no-one knows exactly when the market will go up or down. This is what the math also states. Equity markets follow a pattern known as a ‘random walk’. This pattern essentially states that tomorrow’s return will be based on yesterday’s return plus a random adjustment.

By diversifying, we are able to reduce the probability that there will be a major drawdown in our portfolio come the time we need it. For example, if we were due to retire in March 2020, our retirement fund would have looked very differently than only a few weeks’ prior if we just had a pension fund of equity investments.

Liquidity

Liquidity means having the ability to turn an investment into cash quickly as payment/cash needs arise.

At Elkstone, we always say that we don’t want to be forced to sell out of a position, because the time we are forced to sell is usually the worst time to sell out of a position. This forced selling tends to happen due to having too much leverage on a position where a drop in the market requires us to post more cash to maintain the investment. This cash is needed at the time our cash balance is low due to a market drop – it’s self-fulfilling and creates a negative snowball effect. This need for liquidity from an investment position is not just when using leverage and can happen at any time.

By diversifying, we can reduce the probability of being forced to sell out of position. Not being forced to sell a position is important as it avoids emotional investing – retail investors don’t capture all returns on offer as they get out of positions when loses have got very bad. This causes them to miss the reversal and initial uplift after the reversal. They tend to get out at the worst time and not back in on time. Chart 2 below shows how having both S&P500 and Gold in our portfolio, an investor was able to offset equity losses providing us liquidity without forcing us to sell our equity position which means the reversal was not missed and we were able to capture all of the upside.

Reduce drawdown & increase portfolio returns

Many will point to reason for diversification to be the reduction in portfolio drawdowns/risk. It is difficult to reduce the ‘risk’ of any individual investment, however diversification is the best tool available to diversify the risk of an investment portfolio. It is however not just about reducing drawdowns as that only takes one side of the equation into account. We can reduce portfolio drawdowns by holding cash. If I have €100 and have it all in equities, I can reduce my expected drawdowns by 50% by holding a portfolio of €50 equities and €50 cash, however my expected returns are also halved. The purpose of diversification is to reduce drawdowns by more than what we dilute returns by; this speaks to risk-adjusted returns. Instead of the goal to be just reducing drawdowns or risk, the goal should be to increase our risk-adjusted returns.

The most common measure for risk-adjusted returns is the Sharpe ratio where the higher the number, the better the risk- adjusted return. Visually on a chart, we want to see smooth and steady increases in our portfolio. Table 1 and Chart 3 below provides an overview of the power of diversification using two assets: Gold and Elkstone’s Liquid Debt Portfolio where we can view the maximum drawdown of different assets and portfolios along with the Sharpe ratio and annualised return of each asset and portfolio.

Chart 3: 50/50 S&P500 & Gold

Table 1: Risk-Adjusted Analysis

Increase portfolio returns: The Tortoise vs The Hare

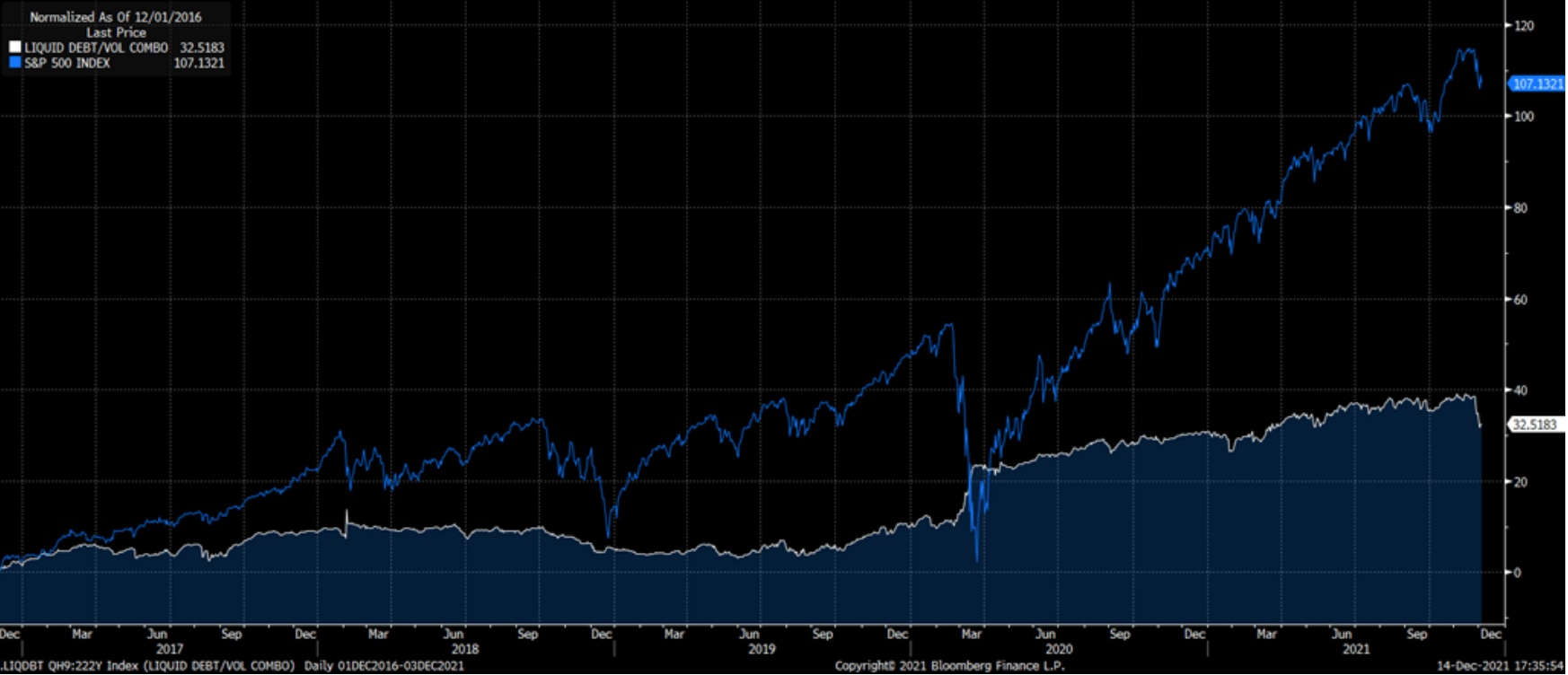

Chart 4: S&P500 & Elkstone Liquid Debt Portfolio since 2016

It’s easy to see in the gold and equity example in the liquidity section above why one would diversify with two assets that provide the same expected return however should I diversify in an asset that has a lower expected return than my core portfolio? Historically, the MSCI All World equity index has returned about 8% annualised. Chart 4 above shows the S&P 500 against Elkstone’s Liquid Debt portfolio which has annualised 6% over its live trading horizon. Can adding a 6% return to a portfolio that expects an 8% return increase the overall portfolio’s performance? The short answer is yes – the magic lies in the drawdown reduction. We have modelled an equity portfolio with an 8% annualised return that has a

-33% loss [same as the covid drop and less than previous decade’s recession loss] every 10 years against a portfolio annualising 6.5% [representing a 75% equity-25% LD portfolio] that has a -20% drop every 10 years. The drawdown reduction comes from the diversification of return streams as can be seen in Table 1 above.

Chart 5 below shows that, as expected, the 8% annualised portfolio gets off to a faster start, however, over time, the lower returning portfolio begins to outperform as the reduction in the drawdown of the portfolio means that the portfolio has a higher base to be driving returns from leading to outperformance in the long run.

Chart 5: Tortoise Vs. The Hare

Related Research

Illiquid Equities: Stock Picking in the Private Markets

Liquid Equity Market Investing: Passive or Active?

Liquid Alternatives: Traditional Commodities

Liquid Debt: Active or Passive?

About the Author(s)

Karl Rogers is the Chief Investment Officer of Elkstone Private. Elkstone is a family office managing the wealth of its principals, with a focus on real estate, venture and alternatives, and a Multi-Family Office, regulated by the Central Bank of Ireland, which provides both access to co-investing in our principals’ investment portfolios and traditional family office services to many of Ireland’s entrepreneurs and HNWIs. Previously to Elkstone, Karl was a Managing Partner with Athlon Family Office, Head of US Power Trading with RISQ, Managing Director of ACE Capital Investments, a hedge fund manager and a proprietary commodity trader.

Karl currently sits in the adjunct faculty for Trinity College Dublin’s M.Sc. in Finance program where he is both a guest lecturer in their alternative investment module and supervises the student’s theses and he is a Special Advisor to the ESG Foundation.

Karl has been referenced in major industry publications including the Wall Street Journal, Bloomberg and the Financial Times and has spoken at numerous family office and alternative investment conferences across multiple continents.

Connect with Karl on LinkedIn.

Important Information

Elkstone Private Advisors Limited [“Elkstone”] is authorised and regulated by the Central Bank of Ireland for the provision of investment services under MiFID regulations. This investment overview (“Overview”) is marketing material and intended to provide summary information about the investment opportunity and does not purport to be comprehensive. It is for information and discussion purposes and may be amended and/or supplemented without notice. The Overview should be read together with any legal and/or regulatory agreements that may govern the investment opportunity (“Investment Documents”) and which contain additional information needed to evaluate the investment, including strategy description, investment product’s risks, fees and expenses. Potential investors are advised to request and carefully read these Investment Documents. In the event of any conflict or inconsistency between the information, views and opinions contained in this Overview and the Investment Documents, the Investment Documents shall apply.

The Overview does not constitute an offer for the purchase or sale of any financial instruments, trading strategy, product or service. No one receiving this Overview should treat any of its contents as constituting investment advice. This document does not consider the suitability of this investment for you, nor does it take account of your investment objectives, knowledge and experience or financial situation. Interested parties are not entitled to rely on any information or opinions contained in this Overview or the fact of its distribution for the purpose of making any investment decision or entering into any contract or agreement with Elkstone in relation to any investment.

All of the solutions we offer involve some form of investment risk and you should be aware that the value of investments may go down as well as up and you may get back less than you invested. Income may fluctuate in accordance with market conditions and taxation arrangements. All simulations, projections, valuations and statistical analyses are provided to assist the recipient in the evaluation of matters arising herein. They may be based on subjective assessments and assumptions and may use one among alternative methodologies that produce different results and, to the extent that they are based on historical information, they should not be relied upon as an accurate prediction of future performance as past performance is not a reliable indicator of future returns. You should ensure that you fully understand the investment and the risks associated with it. You are entirely responsible for any investment decision you make. If you are not satisfied that you fully understand the investment or are unsure about its suitability in the context of your own individual circumstances, you should not proceed to invest. Elkstone takes no responsibility for and shall not be liable in respect of any losses arising from the investment and/or any investment decision made by you following use of this Overview and the Investment Documents. You are advised to request copies of any Investment Documents and to make your own independent commercial assessment from the information and to obtain any independent professional advice as may be appropriate (including inter alia legal and tax advice), before making an investment decision.

Statements, expected performance and other assumptions are based on current expectations, estimates, projections, opinions and/or beliefs of Elkstone at the time of publishing. These assumptions and statements may or may not prove to be correct. Some of the information contained in this Overview has been obtained from published sources or has been prepared by third parties. While such sources are believed to be reliable, Elkstone shall have no liability, contingent or otherwise, to the user or to third parties, for the quality, accuracy, timeliness, continued or completeness of same, or for any special direct, incidental or consequential damages which may be experienced because of the use of the data or statements made available herein. While reasonable care has been taken in the preparation of this Overview, no warranty or representation, express or implied, is or will be provided by Elkstone or any of its shareholders, subsidiaries or affiliated entities or any person, firm or body corporate under its control or under common control or by any of their respective directors, officers, employees, agents, advisors and representatives, all of whom expressly disclaim any and all liability for the contents of, or omissions from this Overview, the information or opinions on which it is based and for any other written or oral communication transmitted or made available to the recipient or any of its officers, employees, agents or representatives. The contents of this Overview is not investment, legal or tax advice.

This Overview is provided on a strictly private and confidential basis. The information is strictly private and confidential and may not be distributed, published, reproduced or redistributed in whole or in part, nor may the contents be disclosed by any prospective investor to any other person other than its professional advisers without prior written consent.